Should first-time investors look at passive investing?

If you are a beginner and wondering how to invest in the stock markets, then you can consider passive investing, which can be done either through exchange-traded funds or index funds

- Teena Jain Kaushal

- Last Updated : March 19, 2021, 17:32 IST

If you are a beginner and wondering how to invest in the stock markets, then you can consider passive investing, which can be done either through exchange-traded funds (ETFs) or index funds. These funds track the index of the market or sectors where they are invested. They are not linked to any single stock instead their underlying asset is the benchmark index such as Nifty or Sensex.

“We at DSP strongly believe that investors and advisors should consider both active as well as passive. Passive funds should be considered as a complementary strategy for their investor’s portfolio,” said Anil Ghelani, Senior Vice President, Head of Passive Investments & Products, DSP Investment Managers.

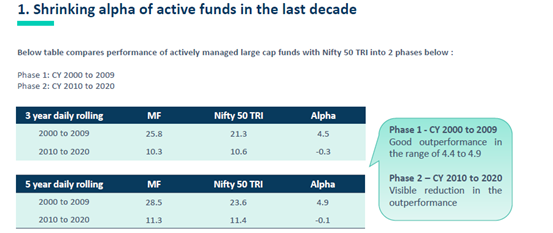

He added that in Indian markets, there is still scope for active funds to outperform the index, especially in the small-cap space. If we, however, look at the large-cap space outperforming the benchmark has become more challenging in recent years. An analysis (See chart) done by DSP shows how the trend has changed over the past 2 decades. We have used rolling returns instead of point-to-point returns. Data shows how an average of all actively managed large-cap funds have performed against the Nifty50 TRI Index over a 3 and 5 year rolling returns period—by taking rolling returns we are observing a very large data set and trying to show returns closest to what an investor would get.”

Costs Involved

Typically, passive investing can be done via ETFs or Index Funds. Ghelani said, “Over the years, we have become very familiar with the concept of total expense ratio (TER) i.e., cost including management fees, custody fee, registrar charges, other operating costs and marketing fees (where applicable). This is a recurring cost of ownership of any mutual fund, including a passively managed index fund which the investor has to bear. The TER is transparently disclosed in the factsheet and on the website of the mutual fund and there are no other implicit costs which the investor has to bear indirectly.”

He added, however, when it comes to the total cost of an ETF, for complete transparency on the cost of owning an ETF, the investor should consider the Total Cost of Ownership or TCO. TCO can therefore be seen as a more complete representation of how much an ETF costs overall. The TCO is calculated by adding all the implicit costs of owning an ETF, to any additional external costs that are more visible to the investor such as broking account opening fees, brokerage charged for buy and sell trades, the bid-offer spread when the ETF is traded.

Which is the cheapest option?

Index funds are costlier than ETFs. But the choice between the two should be based on various factors. For example, ETF is suitable for an investor who has a Demat account. Index fund is better suited to an investor looking for day-end NAV pricing and who doesn’t have a Demat account. Moreover, you can have an SIP in index funds but not in ETFs because, on each installment date, the investor needs to trade and buy the requisite units on the exchange. However, a few broking houses often provide a facility whereby a standing instruction can be placed for an order to be put out on the exchange.

New Launches

Aditya Birla Sun Life Mutual Fund launched on March 18 two new index funds focused on the Nifty midcap and smallcap indices. While the Nifty midcap 150 index fund is an open-ended scheme tracking the Nifty midcap 150 TR index, the Nifty smallcap 50 index fund is an open-ended scheme tracking the Nifty smallcap 50 TR (total return) index, the company said. Both the schemes are open and will close on March 26, the fund house said.

A broad-based market rally is a favourable period for the mid and small caps to outperform, Aditya Birla Sun Life AMC chief executive A Balasubramanian said, adding the cyclical recovery that is being witnessed now also sets a stage for mid and small caps to do well as they have higher exposure to the domestic economy.

The new two index funds provide an opportunity for investors to participate in broader market opportunities. For those seeking to enter higher-growth midcap and smallcap stocks, index funds in mid and smallcap spaces can provide a lower-risk alternative with the advantage of lower cost, he added.

Download Money9 App for the latest updates on Personal Finance.

Related

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा

- कितने तरह के होते हैं ETF, आपके लिए क्या है बेहतर?

- ETF में पैसे लगाने के 4 बड़े फायदे, Investment से पहले जान लें ये बातें