These five mutual fund schemes have outperformed Nifty

It has been a dream run for the Indian stock markets since the announcement of the growth-oriented Budget. Benchmark equity indices BSE Sensex and NSE Nifty have soared more than 10%. The 30-share index has advanced 5,023 points to 51,309 on February 10 from 46,285 on January 29 last month. Likewise, the 50-share index Nifty50 […]

It has been a dream run for the Indian stock markets since the announcement of the growth-oriented Budget.

Benchmark equity indices BSE Sensex and NSE Nifty have soared more than 10%. The 30-share index has advanced 5,023 points to 51,309 on February 10 from 46,285 on January 29 last month. Likewise, the 50-share index Nifty50 has added 1,472 points during the same period.

If we look at the one-year period the returns are even higher. Sensex rose over 25% from 40,979 on 10 February 2020 to 51,531.52 on February 11, 2021. While the Nifty50 index gave similar returns rising from 12,031 levels to 15,106 in the same period.

But do you know 36.48% or 162 equity mutual fund schemes have actually outperformed Nifty50 index over the last one year? Yes, you read it right.

Mutual funds aim to outperform the benchmark indices through active management of the portfolio by way of right stock/sector selection and allocating its correct weightage in the portfolio. Therefore, the performance of mutual funds may differ significantly from its benchmark index.

“Active means you are taking more bottom-up research-driven calls. So, to that extent, the Indian economy where it is has a long way to grow. Hence one needs to hunt for good quality business, in terms of growth, ROI, good management, and then buy at a reasonable price. I think one needs to keep a bit of discipline because the last year tested psycho graphic discipline. You should have adequate diversification and buy the right set of stocks and a more constructed diversified portfolio that can handle mistakes & deliver a decent set of returns,” said Neelesh Surana, CIO, Mirae Asset Management.

Doing such in-depth research and being right is not possible for everyone. Hence selecting the right stock and allocating optimum amount for the particular stock is best left for the fund manager.

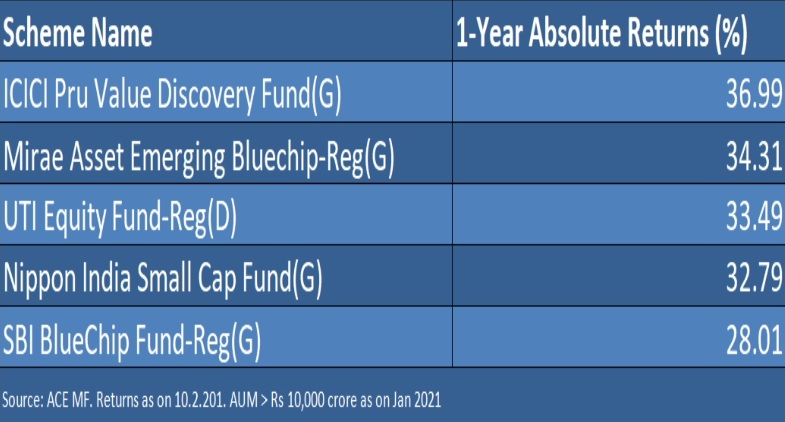

The above listed are the top-5 performing mutual fund schemes based on their one year absolute returns and AUM size (over Rs 10,000 crore) as on January 2021. We are specifically considering one-year return because at the start of the period, Indian economy was battling a slowdown and then COVID-19 struck, leading to a bloodbath on D-Street. A strong recovery followed, with Indian indices touching lifetime highs.

“Our Value Discovery Fund follows value style of investment approach. Many of my global investment gurus have found value investment style to be most rewarding for long term wealth creation. We are of the view that if investors are taught what value investing stands for, then they will become patient investors and not worry about short-term performance. One year ago, both pharma and IT sectors were underperforming for nearly a period of five years and many good names in these sectors were available at cheaper valuations. The fund became overweight on select stocks in pharma sector and subsequently the investments have started delivering handsome returns over past one year” said S Naren ED & CIO, ICICI Prudential Mutual Fund.

“Our ability to pick up winners based on strength of our research has helped us beat the benchmark over longer period,” says Samir Rachh, Equity Fund Manager, Nippon India Mutual Fund

(Disclaimer: The above list is for informational purpose only. Please consult your financial adviser before investing)