These short duration funds are your alternatives to small savings schemes

Interest rates in small saving schemes are bound to go down in time to come.

A sharp interest rate cut of up to 1.1% in small saving schemes came in as a shocker for savers across the country on 31st March 2021 late evening. However, in the early morning of Thursday, April 1, 2021, the government withdrew the steep interest rates cuts on small savings schemes, citing oversight as a reason.

“Interest rates of small savings schemes of the government shall continue to be at the rates which existed in the last quarter of 2020-2021, i.e., rates that prevailed as of March 2021. Orders issued by oversight shall be withdrawn,” Finance Minister Nirmala Sitharaman tweeted.

In the first quarter of 2021-22, PPF will continue to fetch 7.1% interest, while National Savings Certificate will continue to earn 6.8%. The interest rate for the five-year Senior Citizens Savings Scheme now stands at 7.45%. The girl child savings scheme Sukanya Samriddhi Yojana will continue to earn 7.6% interest. The annual interest rate on Kisan Vikas Patra continues to be 6.9%. The rollback came in on the day when Bengal and Assam are voting in the second phase of state elections.

Commenting on the activity in small saving schemes Kalpesh Ashar – CFP, Full Circle Financial Planners said, “while the government has revoked interest rate cut in small savings schemes. But surely the interest rates in small saving schemes are bound to go down in time to come.”

While small saving schemes offer a good amount of security on the capital protection front, but the low-interest rate can be a dampener for you. An investor should not panic and stick to asset allocation for various goals in the fixed income space, mentioned Ashar.

If you are looking for an alternative to hedge yourself against interest rate risk but are also looking for capital protection. Well, then short duration funds can be your go-to place. Let us first understand what short duration funds are.

Short duration funds

Mutual funds that invest in money market securities such that the duration of the fund portfolio is between 1 to 3 years. According to SEBI norms, short-duration funds are expected to have durations between 1-3 years. This means that short duration funds can invest in the short term as well as slightly longer-term debt securities. In terms of interest rate risk, short-duration funds are positioned at the lower end: higher than liquid, ultra-short duration, and low duration funds but lower than medium and long duration funds.

Credit risks in short duration funds vary depending on the asset allocation. Some fund managers invest mainly in the highest quality bonds, while others may allocate a significant part of the corpus to AA and lower-rated debt to boost returns. However, it must be noted that short duration funds usually have lower default risk as compared to credit risk funds.

These funds also offer the benefit of indexation if held for more than 3 years.

“Short duration funds are a good alternative, but investors should stick to debt funds that invest in AAA-rated papers for a duration of 2-3 years,” added Ashar.

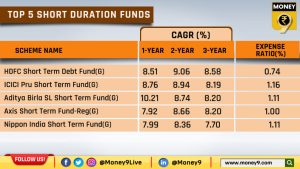

Here are the top five short-duration funds

The above funds are shortlisted based on a 2-year return with an AUM size of over Rs 1,000 crore.

(Disclaimer: The above list is for informational purpose only. Before investing, please consult your financial advisor)