Weekly SIPs v/s monthly SIPs: Which one should you choose

Just by converting a monthly SIP of Rs 1,000 to a weekly SIP of Rs 250, you can end up earning Rs 6,914 more at the end of 10 years assuming an expected rate of return of 10%

- Harsh Chauhan

- Last Updated : March 23, 2021, 10:19 IST

A few years ago when billionaire Mukesh Ambani launched Jio 4G broadband services throughout India he reduced the billing cycle from 30 or 31 days to 28 days. The overall impact of this move enabled Jio to charge its customers 13 times in a year instead of 12 times. Smart right! But do you know even you can use the same tactic and become rich? You must be wondering, how is that possible? Well for that you just need to convert your existing systematic investment plan (SIP) from monthly to weekly.

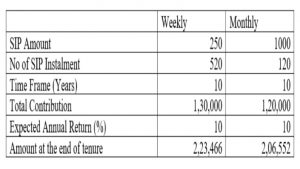

For instance, if you are investing Rs 1,000 every month through a SIP, your annual investment works out to be Rs 12,000. Well, if the same SIP is converted into a weekly SIP your weekly outgo will be at Rs 250 assuming four weeks in a month. In this case, your annual contribution towards SIP will work out to Rs 13,000 (52 weeks x Rs 250). Now let’s assume you do the contributions for 10 years and earn 10% returns year after year. At the end of ten years, you end up earning Rs 16,914 more through weekly SIPs compared to monthly. Here is the detailed calculation for your understanding.

Advantages of a weekly SIP

As you can see in the chart above, the weekly SIP plan provides the investor with higher absolute returns in the long term. SIPs are considered an important instrument to avoid risks arising from timing the market, which essentially means, by investing small amounts periodically, the risk of investing at the wrong time is substantially reduced. Let’s now understand the pros and cons of weekly SIP.

Weekly SIPs help investors reduce the risk from market timing. As you invest weekly, which is more frequent, the risk to invest at the wrong time is reduced.

You can average the purchase cost and maximize profits. As you invest frequently over a short period, you tend to accumulate a high number of units when the market is low and vice-versa.

Disadvantages of a weekly SIP

In monthly SIP, inflows and outflows are synchronized in an investor’s bank account. It’s easier to manage and keep track of outflows in a monthly SIP. However, in a weekly SIP, investors need to manage and track their cash flow and account balances effectively, to ensure SIP investments are made without fail.

There is a general belief that, if an investor opts for a weekly SIP, he/she would evaluate their investments too often, and the short-term fluctuations might impact their investment decisions.

While a weekly SIP does have a marginal benefit over monthly SIP, however, if you are someone who can’t manage cashflows easily or will be tempted to change investment decisions before achieving your goal then you should opt for monthly SIP.

Download Money9 App for the latest updates on Personal Finance.

Related

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा

- कितने तरह के होते हैं ETF, आपके लिए क्या है बेहतर?

- ETF में पैसे लगाने के 4 बड़े फायदे, Investment से पहले जान लें ये बातें