Who should invest in credit risk mutual funds?

Earnings from credit risk funds are taxed like debt mutual funds.

- Himali Patel

- Last Updated : May 6, 2024, 14:33 IST

Credit risk mutual funds are debt funds that invest in low-rated corporate bonds. These corporate bonds generally have the potential to offer higher returns because these funds lend to weaker, lower-rated companies at higher interest rates. Hence, there is a high risk on investment. There is a bigger risk of making defaults. If the company that issues the bonds fails to repay interest or principal, it can lead to a payment crisis.

The portfolio of credit risk funds focuses on lower-rated securities. Due to higher risk, these funds have less liquidity. This can pose a problem when you redeem your investments. In such situations, investors can get stuck in a crisis. If the company which ussues the bonds defaults, gets downgraded or even shuts down, the fund‘s Net Asset Value or (NAV) can decrease. This can negatively impact the investor’s returns.

Earnings from credit risk funds are taxed like debt mutual funds. There has been a change in the tax regime for debt funds from April 1, 2023. The benefit of Long Term Capital Gain or (LTCG) indexation has been removed on debt funds. Earlier, the benefit of indexation was available on redemption if held for 3 years, but from April 1 2023, the income from debt funds fall under the Short Term Capital Gain category. Although the investment period may be anything. The profit from this investment will be added to the investor’s annual income, on which tax will be levied based on the tax slab. After the government brought this change, there has been continuous outflow from credit risk mutual funds in the past year. In February 2024, outflows worth of 365.9 crore rupees was seen in this category.

The return of debt mutual funds is influenced by RBI’s policy rates. Changes in interest rates by the central bank affect the returns of debt funds like credit risk funds because wherever your money is invested, those companies have to return it with the same proportion of returns. If the interest rate is high, the returns may also increase along with the risk.

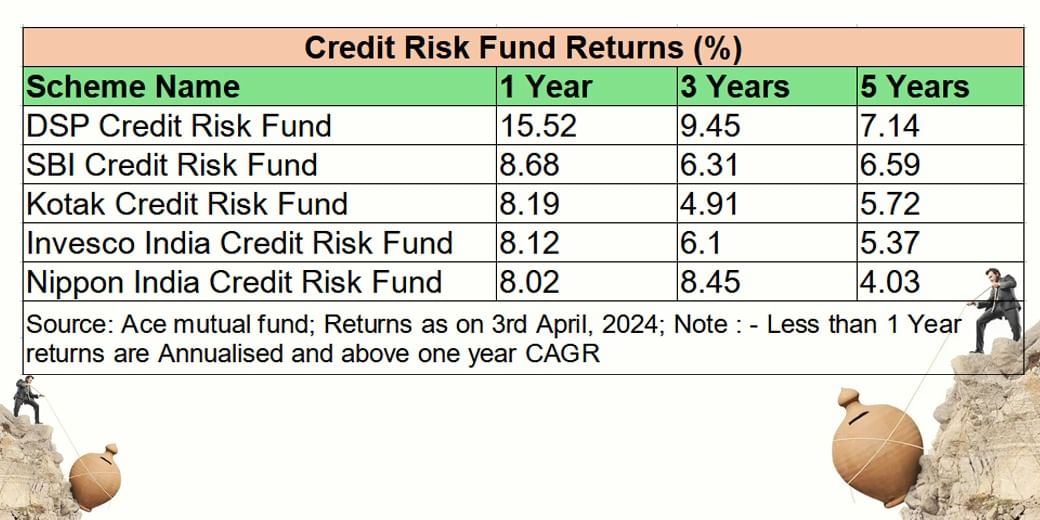

Now let’s see how much returns people have got. According to the figures as of April 3, 2024, DSP Credit Risk Fund has given returns of 15.5% in the past year, 9.45% in three years, and 7.14% in five years. During this period, SBI Credit Risk Fund has given returns of 8.68%, 6.31%, and 6.59% respectively. Invesco India Credit Risk Fund has given returns of 8.12%, 6.1%, and 5.37% in 1, 3, and 5 years respectively. Meanwhile, Nippon India Credit Risk Fund has given return of 8.02%, 8.45%, and 4.03%.

Now the question arises, what should investors do?

Remember that credit risk funds are riskier compared to other debt fund types because these funds invest a significant portion of the portfolio in lower-rated companies. If you want to take some risk for higher returns, you can invest in such funds. Like Mukesh, one should not invest in credit risk funds for just 2-3% higher returns than debt funds.

According to market experts, dynamic bond funds could prove to be a better option. The primary objective of dynamic bond funds is to maximize returns in both rising and falling interest rate scenarios. Fund manager decisions and management depend on changes in interest rates made. The fund manager adjusts the portfolio based on the fluctuations in interest rates.

Senior fund manager Pankaj Pathak at Quantum AMC, says that, you get the benefit of flexibility in dynamic bond funds in case things don’t go as expected. However, to avoid the risks of market fluctuations, investments should be made with a perspective of 2-3 years. For short-term and low-risk options, one can invest in liquid funds.

Liquidity is the biggest issue in credit risk funds because there is no secondary market for lower-rated debt securities in the country yet. This makes it difficult to make changes in the portfolio and sometimes even redeemption becomes challenging. Considering the current market situation, Mukesh should consider shifting to dynamic bond funds. For more information on this, you can seek assistance from a financial planner.

Published: April 19, 2024, 14:36 IST

Download Money9 App for the latest updates on Personal Finance.

Related

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा

- कितने तरह के होते हैं ETF, आपके लिए क्या है बेहतर?

- ETF में पैसे लगाने के 4 बड़े फायदे, Investment से पहले जान लें ये बातें