Money9 Edit | Can U-shaped coronavirus again halt V-shaped bull run?

Any further rise in the US bond yields, increase in global commodity prices may lead to a contraction in margins, inflationary pressure and sky-high valuations may keep the markets volatile going ahead

Concerns over rising Covid cases and fear of lockdown have once again put the brakes on the dream bull run of Indian equity markets. The benchmark equity index BSE Sensex has nosedived more than 4,000 points to 48,471 on March 25 from its all-time high of 52,516, scaled on February 16 last month.

However, the index is still sitting on a gain of 82% from the closing of March 24, 2020, the day when the nationwide lockdown was announced.

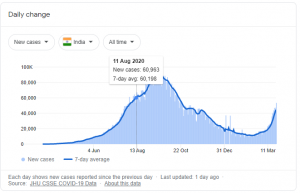

Will the market correct further or it is a temporary correction? Undoubtedly, the long-term story of the Indian economy stays intact and chances of complete lockdown looks meagre. However, an investor should keep an eye on coronavirus cases, that are showing a ‘U’-shaped kind of rise again (See graph).

This looks scary for the equity markets, which witnessed a V-shaped recovery during the one year of lockdown.

Source: Google

With factors like announcement of series of foreign investments in Reliance Jio, stimulus from the government, huge liquidity and inflows by FIIs, unlocking of Indian economy to earnings uptick have supported Indian equity markets during the past four quarters.

Going ahead, there are hopes that loose monetary policy and low rate of interest may provide additional cushion to companies. As a result, India Inc may post 20%-25% growth in earnings in FY22 and FY23. Therefore, investors should stick to companies with a proven track record and focus on diversification across asset classes.

Lastly, investors should also zero in on external factors while investing in equities. Any further rise in the US bond yields, increase in global commodity prices may lead to a contraction in margins, inflationary pressure and sky-high valuations may keep the markets volatile going ahead. Therefore, one should not board the bus in a hurry and try to lap up quality stocks on dips only.