Term plan: Beware of these traps

Prudent choice is an individual should always choose the regular payment term

- Nishant Batra

- Last Updated : July 1, 2021, 11:04 IST

While purchasing term plan, the insurance company provides various “frequency paying” options to the customer, it can be:

1. Premium Payment Term = Policy Term, so if the life cover is for 30 years, the policy holder will keep paying the premium for 30 years (payment frequency can be monthly, quarterly, half yearly or yearly). Also known as regular pay option.

2. Premium Payment Term < Policy Term, in this case the policy holder will front load the premium and pay in 5,7,10 years even if the life cover is for 30 years.

3. Single Premium, in this case the policy holder pays “one single BIG premium” and the life cover stays for the whole policy term.

In this article, we will dissect how opting for 2 and 3 is injurious to financial health.

In my observation, this is one of the mistakes which is not much influenced by insurance agents and mostly Do-It-Yourself Investors fall into the marketing gimmicks of insurance companies.

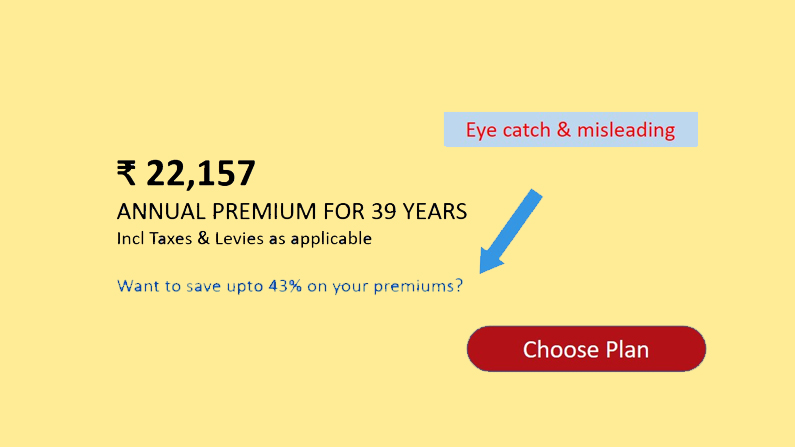

Let’s understand this by an example and take a hypothetical case, for male person “Amit Kumar” born on 01st Jan’1985 and who is not a tobacco user. Let’s calculate the premium from one of the leading private sector life insurance company for sum insured of Rs 1 crore, for policy term of 39 years and yearly premium payment term of 39 years. Premium comes to Rs 22,157.

Now, when you come to the page of choosing the plan, here it how it looks:

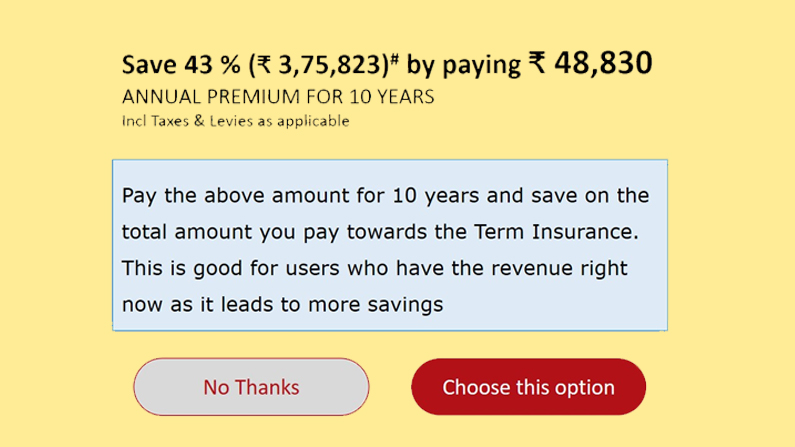

If you are going to click this option, a new window will pop-up:

I hope saving 43% was so easy, just click on a button and believe in simple mathematics of a leading insurance company.

Single Premium for the same policy is coming out to be ₹ 3,95,903 for the whole policy term of 39 years.

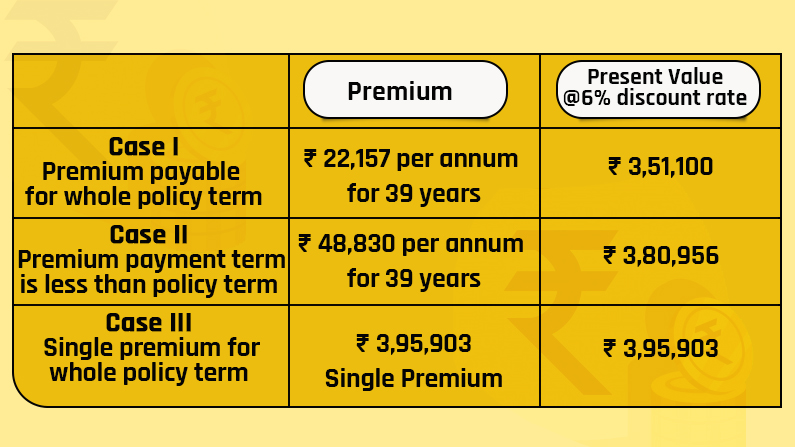

Now, the customer has three options to choose from:

— Pay Rs 22,157 for 39 years (equivalent to policy term) — Pay Rs 48,830 for 10 years (premium payment term= 10 years is less than policy term = 39 years) — Pay Rs 3,95,903 one time for whole policy term of 39 years

As these numbers are different and are for different number of paying periods, Present Value will be an ideal matric to compare these cash flows. Let’s discount these cash flows at 6%.

As you can see, the lowest present value for these cash flows is in Case I.

A claim in first year itself will mean, that Case I has paid only Rs 22,157 as against Rs 48,830 in Case II and Rs 3,95,903 in case III whereas claim amount is same, Rs 1 Crore.

In case II and III, even after achieving financial freedom, the policy holder doesn’t have the option of discontinuation of policy and save premium.

Prudent choice is an individual should always choose the regular payment term.

Download Money9 App for the latest updates on Personal Finance.

Related

- साउथ इंडियन बैंक का दूसरी तिमाही का शुद्ध लाभ आठ प्रतिशत बढ़कर 351 करोड़ रुपये हुआ

- एसबीआई जनरल इंश्योरेंस, स्टारफिन इंडिया ने कम आय वाले परिवारों के लिए पेश की योजना

- अब महज 15 दिनों में होगा डेथ क्लेम सेटलमेंट, IRDAI ने बीमा कंपनियों को दिए सख्त निर्देश

- Health insurance vs. Medical corpus: What’s your choice?

- Can Homebuyers Expect Tax Rebate from Budget’24?

- Budget 2024: Insurers anticipate tax reforms in health insurance