A look at best-performing mutual fund schemes

Here we take a look at the best-performing mutual fund schemes that can help you achieve your life goals

- Harsh Chauhan

- Last Updated : March 27, 2021, 12:00 IST

1/10

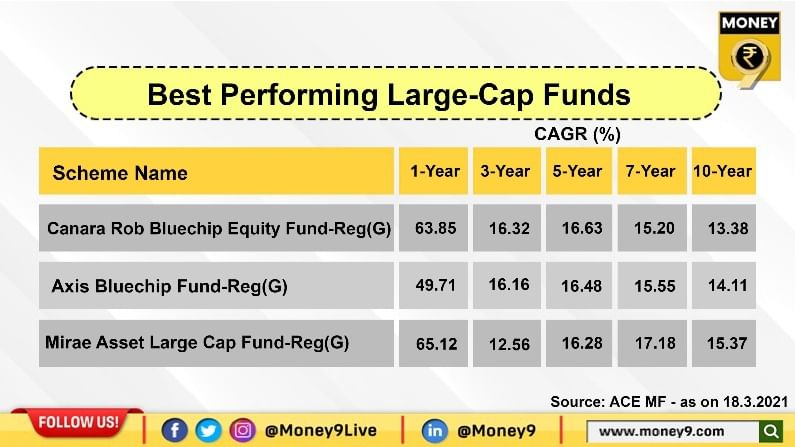

Large-cap funds are those funds that invest a larger proportion of their corpus in companies with large market capitalisation.

2/10

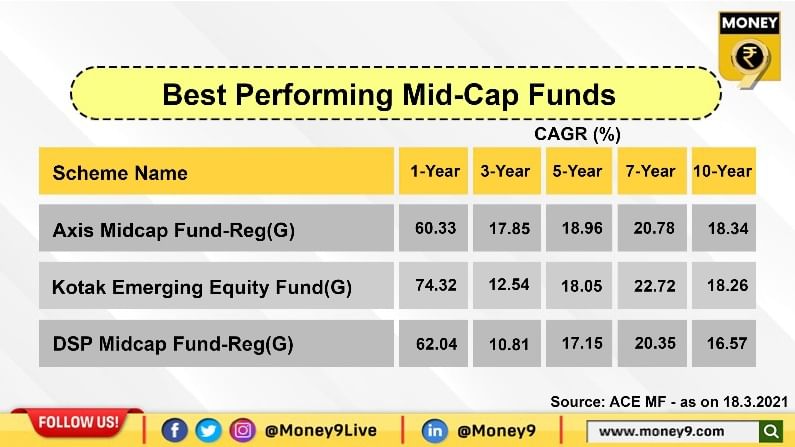

Mid-cap funds are a type of equity mutual funds that invest in mid-sized companies. According to the norms, companies that are ranked from 101 onwards till 250 based on their market capitalization are categorized as mid-cap companies.

3/10

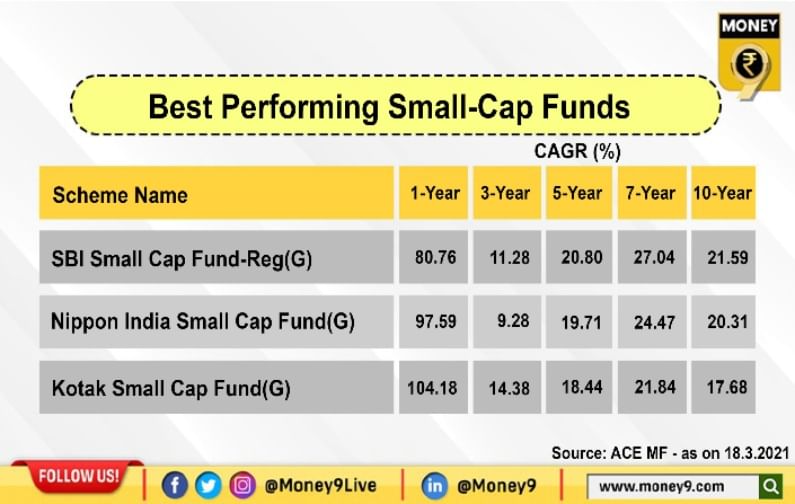

Small-cap funds invest a major portion of their investible corpus into equity of small-cap companies.

4/10

Equity Linked Saving Schemes (ELSS), popularly known as tax saving mutual funds, are equity-oriented mutual funds. These funds come with a lock-in period of 3 years and qualify for a tax deduction of up to Rs 1.5 lakh per financial year under Section 80C.

5/10

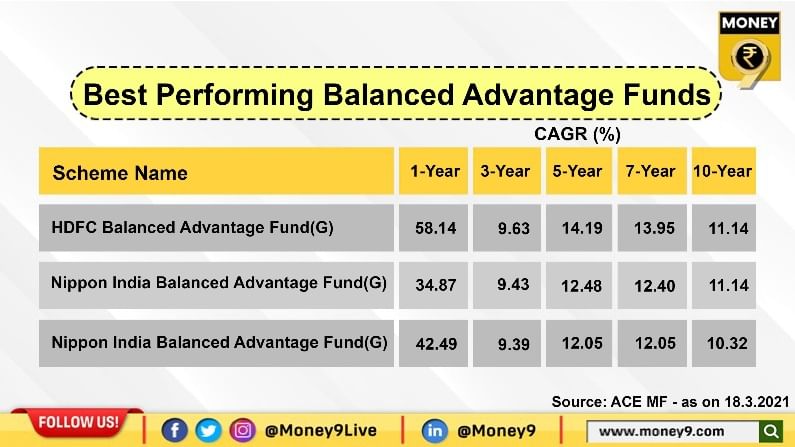

Balanced Advantage Funds are free to manage their exposure to equity and debt instruments without any caps. These funds change their exposure to equity and debt instruments as per the changing equity valuations with the help proprietary models.

6/10

Mutual Funds which are listed and traded on stock exchanges like shares are known as Exchange Traded Funds better known as ETFs.

7/10

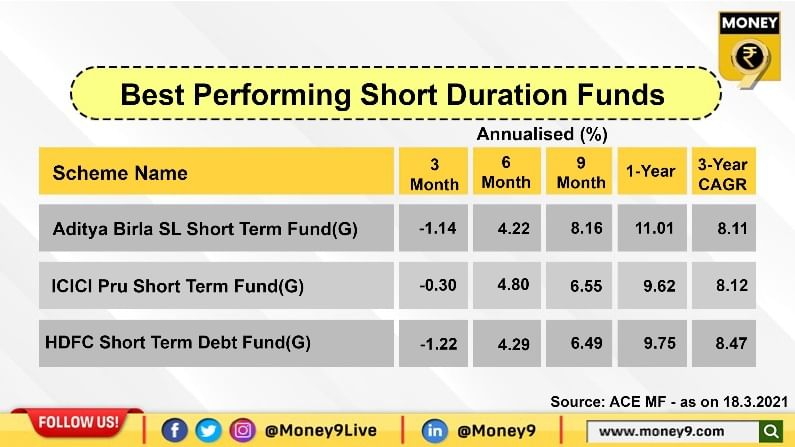

Short duration funds are debt funds that invest in debt and money market securities such that the duration of the fund portfolio is between 1 to 3 years.

8/10

Low duration funds are debt funds that invest in short term debt securities between 6 to 12 months.

9/10

Ultra Short Duration Funds are debt funds that lend to companies for a period of 3 to 6 months.

10/10

Liquid Fund is a debt fund that invests in fixed-income instruments like commercial paper, government securities, treasury bills, etc. with a maturity of up to 91 days. The net asset value or NAV of a liquid fund is calculated for 365 days. Further, investors can get their withdrawals processed within 24 hours. These funds carry the lowest interest-rate risk. Based on 9-month returns with AUM size of more than Rs 1,000 crore.

Published: March 20, 2021, 19:43 IST

Download Money9 App for the latest updates on Personal Finance.

Related

- इक्विटी म्यूचुअल फंड में निवेश मई में 21.66 प्रतिशत घटकर 19,013 करोड़ रुपये

- जियो ब्लैकरॉक म्यूचुअल फंड ने शीर्ष स्तर पर अधिकारियों की नियुक्ति की

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा