MPC expected to retain key rates unchanged but focus on price rise

The MPC’s tone may have strong focus on inflation management, given the sustained high prices of vegetables

The Monetary Policy Committee meeting this week is expected to hold key policy rates unchanged at the meeting on August 8-10, though vegetable prices – especially those of tomato and onion – are supposed to turbocharge retail inflation to levels beyond the Reserve Bank of India’s comfort zone. A poll held among 15 economists indicated that the MPC is widely expected to retain repo rate at the current 6.5% level, The Economic Times reported.

The repo rate – the interest rate at which the central bank lends to commercial banks – was last hiked on February 8 this year from 6.25% to 6.5%. It has been retained at that level in the past two MPC meetings.

To contain inflation primarily led by a surge of liquidity in the market, RBI hiked the repo rate from 4% to 6.5% between April 2022 and February 2023.

“The MPC’s tone is likely to have a strong focus on inflation management, given the likelihood of two successive (inflation) prints of about 6%. It terms of forecast changes it is better to wait for the September or October policy because they will have more clarity on the monsoon,” said Anubhuti Sahay, Standard Chartered Bank’s Head of South Asia Economic Research.

The retail inflation levels could, however, cause discomfort to RBI, though the reasons might more be due to supply disruptions/constraints rather than due to more liquidity in the system.

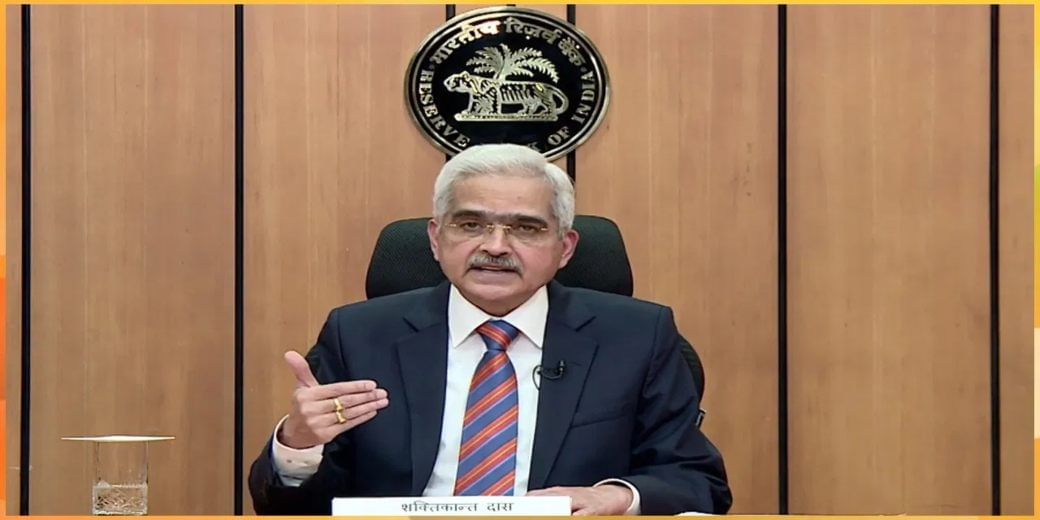

The CPI index travelled south in March-May period. It hit 4.25% in May but rose to 4.81% in June. Tomato prices appeared to the villain but its full impact could be felt in the July data which is yet to be reported. The CPI inflation could climb well over 6% in July with most economists predicting it to be within the 6-6.5% band. The RBI’s official zone of comfort in 2-6%. However, after the last MPC meeting, RBI governor Shaktikanta Das said that they would keep 4% as the target.

In a recent statement the RBI said, “The recent spike in tomato prices on account of crop damage due to inclement weather and pest attacks in the major production belts has received widespread attention as it has taken a toll on household’s budgets. Tomato, being a highly perishable item with a very short crop duration, exhibits considerable seasonal variation in prices but these episodes are short-lived.”

However, the road ahead might extract tears with analysts apprehending onion prices to shoot up, thanks to supply-demand mismatches.

“The supply-demand imbalance is expected to reflect in onion prices towards end-August. Prices are expected to show significant increase from early September, reaching up to 60-70 per kilogram during the lean patch. However, prices will remain below the highs of 2020,” said rating agency Crisil.

“Sharp peaks and troughs in prices historically have been common across the three main vegetables, tomatoes, onions and potatoes. In each cycle, the duration of peak-to-trough is shorter than it is for non-perishables – at five months for tomatoes, nine months for onions and 11 months for potatoes,” said Rahul Bajoria, an economist with Barclays.

Ahead of an election year, the government has been prompt in pre-empting food price rise. It has quickly proscribed the export of non-basmati rice to prevent a surge in rice prices after prices began moving northwards for a few weeks.

Commercial LPG prices are being reduced gradually. After bumper profits of oil marketing companies, a reduction in petrol and diesel prices could not be ruled out completely.

Download Money9 App for the latest updates on Personal Finance.

Related

- Reduce your premium with health insurance deductibles

- LIC may sell properties, land to net over $7billion

- Get ready to pay for the mobile number!

- What are IRDAIs latest norms saying on moratorium and waiting period?

- Labour codes may be priority reform area in first 100 days of new govt

- LPG price cut: OMCs cut commercial cylinder prices ahead of elections