Is it right time to invest in residential real estate?

Prices of residential real estate seems to have bottomed out and may deliver over 10% return over the next two years

- Rahul Oberoi

- Last Updated : January 19, 2021, 09:20 IST

Prices of residential real estate seems to have bottomed out and may deliver over 10% return over the next two years on likely increase in demand amid record low home loan interest rates.

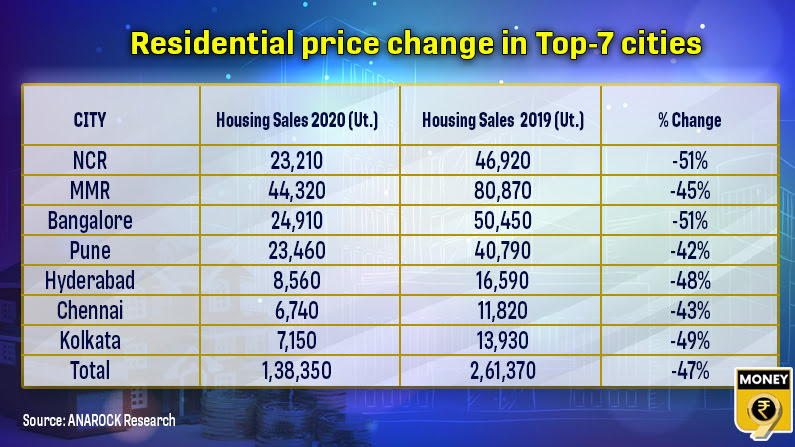

There are also expectations that sales momentum that picked up during the December quarter may continue in 2021. According to Anarock data, housing sales in the October-December rose to 50,900 units across seven big cities from 29,520 units in the previous quarter. Nevertheless, the sales fell 47% to 1.38 lakh units in 2020 against 2.61 lakh units last year.

Global financial firm Jefferies believes that prices of residential real estate may rise by more than 10% over the next two years. “A new residential cycle start should become evident over 2021 as both end-users and investors get back into action. We expect residential sales to cross 2019 levels, inventory to fall to 8-year low by end of 2021,” it said.

Anuj Puri, chairman, Anarock added that the residential real estate segment seems to have bottomed out now. “Buoyed by the rising sales, developers also saw it fit to unleash ample new supply into the market, leading to a 2% year-on-year rise in Q4 of 2020 against the same period in 2019. The new supply was dominated by strong branded developers. This strong growth in Q4 has set the stage for the revival of residential activity in 2021 as well,” he added.

At present, home loan interest rates are hovering at around 6.75-7% which bodes well for the real estate sector. “Low rates, along with likely double-digit income growth should keep affordability at cycle best levels. Investment demand is also improving as evident by sales pick-up even at the high-end,” said Jefferies.

It further added that the government support to housing have also created the impression of property prices being at cycle-low levels. The post-Covid volume recovery has happened with only limited (5-10%) price-cuts, which demonstrates improved affordability and customers’ belief that prices are attractive.

“As reopening continues, and current momentum builds, there are hopes that residential sales to rise through 2021, to around 10% above 2019 levels. Even then, 2021 sales would be 30% below peak and 10% below the 2010-2019 decade average levels, indicating significant growth possibilities ahead,” said Jefferies.

On the other hand, Mani Rangarajan, Group COO, Housing.com, Makaan.com and Proptiger.com said, “Overall, we are seeing that buyers’ outlook towards real estate is positive given the re-inforced importance of a home, lower interest rates and higher volatility in other asset classes. We do not anticipate any further downward trend in prices over the next year. On the contrary, we may well see some price increase in certain micro-markets contingent on economic recovery and continued growth in demand.”

Download Money9 App for the latest updates on Personal Finance.

Related

- डीएलएफ ने गुरुग्राम में 11,000 करोड़ रुपये में बेचे 1,164 लग्जरी अपार्टमेंट

- YEIDA launches 361 plots for sale near Noida airport

- LIC may sell properties, land to net over $7billion

- Land owners in Amaravati hit a lottery

- Check these out before buying property

- Builders must get occupancy certificate before giving possession: UP RERA