NPS: Should you invest in its Tier-II account?

Experts suggest people should view NPS as a long-term investment option

NPS has emerged as a popular retirement investment option. It gives you a wide range of flexibility with an option to invest in equities, government or corporate bonds. This scheme is open to all Indian residents and anyone who registers with NPS, gets a Tier 1 account by default.

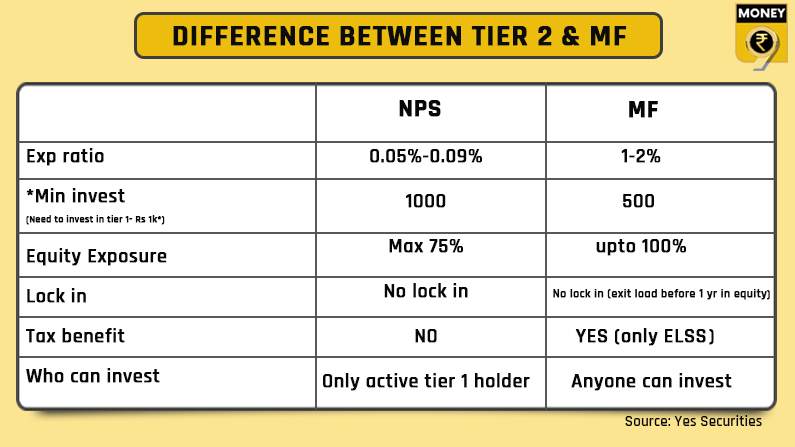

On the other hand, Tier-II is an optional investment account, which is available only to active Tier-I account holders and is not a pension account. While Tier-I comes with withdrawal restrictions, there are no withdrawal restrictions when it comes to Tier-II account. It allows you to withdraw money unlimited times and gives you the advantage of a low-cost structure. Being a low-cost product it can clearly give a much-needed fillip to your portfolio earning you a higher return.

So, are there any rough edges that investors should keep in mind?

Expert take

“I don’t usually recommend to invest in Tier II. One can withdraw anytime, however investments in equity/debt is within a defined band. My advice would be to follow goals and risk profile and invest in mutual funds. More freedom to manage and better performance. No restrictions too. Easier to transact,” said Shweta Jain, founder and CEO of Investography, the Bengaluru-based financial planning company.

One of the biggest advantages of NPS Tier-II account compared to Tier I account and mutual funds is that withdrawals are permitted without any restrictions. However, given the low cost and easy withdrawal from Tier II account, many people treat it as a saving bank account. Is it the right approach?

“Many people treat Tier-II as a saving account. It is a wrong approach as one should invest in Tier-II only for long term purposes given the money is invested in government and corporate bonds. There is interest risk if money is invested for a short tenure. Savings bank account on the other hand has a fixed return with no risk, ” said Pankaaj Maalde, a Mumbai based financial planner.

Long-term investment option

Experts suggest people should view NPS as a long-term investment option.

“Diversification, asset allocation and discipline are three strong pillars of long-term wealth creation. For long-term wealth creation, one can look at NPS Tier-II investment option. Tier-II allows diversification and asset allocation features. NPS expense ratio is very nominal as compared to Mutual Fund and PMS. As we say, money saved is money earned,” said Tushar Bopche, Product Head – AUM Business, Yes Securities.

Taxability of NPS Tier-II account

The taxability on withdrawals from the NPS Tier-II account needs clarity from the income tax authority and NPS both. The withdrawals cannot be taxed similar to Tier I because the investment is not eligible for Section 80CCD. No tax benefits are available on contributions made in an NPS Tier-II account. Moreover, the assessee is liable for taxation as per the marginal tax rate applicable to their income.

Though Tier-II account of NPS has advantages of low cost and unlimited withdrawals, experts feel that until there is clarity about the tax treatment, it is better to stay away from it.