Get more from HDFC Bank's special FD scheme

If you are planning to invest in FDs, HDFC Bank has introduced two special FD schemes that offer attractive interest rates

HDFC Bank has launched two special fixed deposit (FD) schemes. Find out how much interest you will receive under these schemes.

Fixed deposits (FDs) have been a preferred investment option for people for a while now. If you are planning to invest in FDs, HDFC Bank has introduced two special FD schemes that offer attractive interest rates. The new rates came into effect from 29th May. According to the official website of the bank, for a 35-month FD, you will receive an interest rate of 7.20%, and for a 55-month FD, you can earn interest up to 7.25%. Senior citizens will receive an additional benefit of 0.50% on the specified FD. It should be noted that other major banks in the country, such as SBI, ICICI Bank, and Axis Bank, are currently offering interest rates ranging from 6.5% to 7% on FDs.

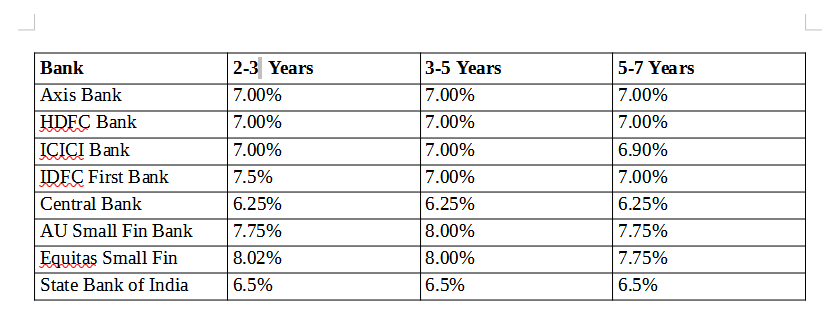

HDFC Bank has also revised the interest rates for its other deposit schemes. Under these schemes, the bank is offering interest rates ranging from 3% to 7.25% on FDs for general customers, with a tenure ranging from 7 days to 10 years. For senior citizens, the interest rate on these FDs ranges from 3.5% to 7.75%. Currently, banks are offering good interest rates on FDs, with most banks providing around 7% interest on various tenures. So, which bank is offering how much interest?

Interest rates on FDs offered by major banks

What is a special FD?

Special FDs work similar to regular fixed deposits. Banks launch these types of schemes to attract deposits for a limited period. The only difference between regular and special FDs is that special FDs offer higher interest rates than regular ones. This varies based on the rules and tenure set by different banks. Many banks have introduced special deposit schemes for senior citizens. Currently, there are several banks in the country, including IDBI Bank and HDFC Bank, that offer special deposit schemes for senior citizens.