Life policies with over Rs 5 lakh premium face tax

Previously, the IT Act exempted the amount received by way of bonuses under a life insurance policy. Now, following these regulations, no life insurance policy whose annual premium payable exceeds Rs 5 lakhs and which has been issued after 1st April, 2023, will not be allowed to benefit from this exemption.

- Ira Puranik

- Last Updated : August 17, 2023, 20:40 IST

In a bid to unveil high-value investments that escape the tax scanner disguised as insurance policies, the Central Board of Direct Taxes (CBDT) has issued guidelines on taxing high-premium life insurance policies i.e. whose annual premium payable exceeds Rs 5,00,000.

Previously, the I-T Act exempted the amount received by way of bonuses under a life insurance policy. Now, following these regulations, no life insurance policy whose annual premium payable exceeds Rs 5 lakhs and which has been issued after 1st April, 2023, will be allowed to benefit from this exemption.

For all premium amounts paid beyond this threshold, the proceeds received will be added to the policyholder’s total income, and then taxed on the basis of his/her tax slab. Notably, this will be counted under the head income from other sources. However, the exemption will continue in the following cases:

- Any sum received under Unit Linked Insurance Plans (ULIPs)

- If the said money is received upon the death of a person.

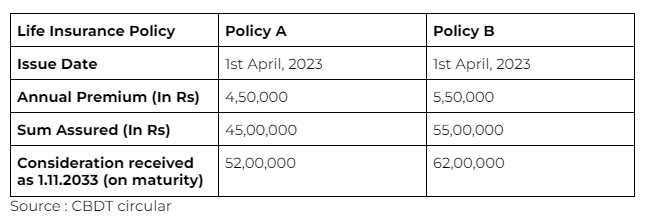

Moreover, all the premiums paid will be exclusive of GST. Let’s understand this through an example. Suppose Mr. Anand has two policies, structured like this:

In this case, considerations from policy A will not be taxed, since the premium payable is below the Rs 5,00,000 threshold. However, since the premiums paid exceed Rs 5,00,000 in policy B, all receipts from it will be counted for taxation purposes. Hence, in case B, Rs 7,00,000 (Rs 62,00,000-55,00,000) will be seen as Anand’s income.

The circular noted that “if any sum is received, including the amount allocated by way of bonus, at any time during a previous year, under a life insurance policy—-which is not to be excluded from the total income of the previous year in accordance with the provisions of clause (10D) of section 10, the sum so received as exceeds the aggregate of the premium paid, during the term of such life insurance policy, and not claimed as deduction in any other provision of the Act, computed in the manner as may be prescribed shall be chargeable to income-tax under the head “Income from other sources.”

Download Money9 App for the latest updates on Personal Finance.

Related

- सरकार ने जारी किया नया Income Tax Calculator, कौन सी रिजीम बेहतर; कितना बचेगा टैक्स

- 12 लाख भूल जाइए 13.7 लाख रुपये तक नहीं लगेगा इनकम टैक्स, जान लें Zero Tax का ये फॉर्मूला

- टैक्स बचाने के लिए ‘इक्विटी लिंक्ड सेविंग स्कीम’ है बेहतर विकल्प, जानें क्या है फायदे

- दिसंबर में 7.3 फीसदी उछला GST कलेक्शन, सरकारी खजानें में जमा हुए 1.77 लाख करोड़ रुपये

- Budget’24: New LTCG rule to hit long-term property owners hard

- Looking to buy gold? Buy now before it’s too late!