This strategy can reduce your LTCG tax liability

Through tax harvesting, one can save tax up to Rs 10,000 every year on long term capital gain earned from equities or equity mutual funds.

If you are someone who has invested in equities or mutual funds and have made windfall gains, then it is time for you to think through your capital gains tax strategy.

Capital gains earned on selling shares and mutual funds after one year are called Long-Term Capital Gains (LTCGs). LTCGs earned below Rs 1,00,000 are exempt from tax in any financial year. LTCGs earned over and above Rs 1,00,000 are taxed at the rate of 10%.

However, there are ways in which you can reduce tax liability on capital gains earned. Wondering how? Well, it is possible through tax harvesting.

What is tax harvesting?

Tax harvesting is an age-old concept of selling the security to realise or ‘harvest’ returns and then buying the same security at a higher price. These transactions will increase the buying of security in your books. This process can be repeated every year to take advantage of the Rs 1 lakh exemption in the case of LTCG. Through this, one can save a tax of up to Rs 10,000 every year. This exemption is available on the aggregate long-term capital gains from equity-oriented mutual funds and stocks.

How does tax harvesting work?

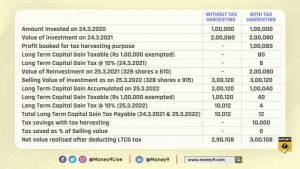

If you still did not understand how tax harvesting works let me explain to you with the help of an example. We assume that you made a maiden investment of Rs 1,00,000 in Finolex Industries on March 24, 2020 when the stock was quoting at Rs 304.85 apiece. This means you bought 328 shares (Rs 1,00,000/304.85) of the company.

On March 24, 2021, the stock closed at Rs 610 which means your maiden investment is now worth Rs 2,00,080 (Rs 610 x 328 shares) giving you a windfall capital gain of Rs 1,00,080. For the purpose of tax-harvesting, you sold 328 shares of Finolex Industries booking a long-term capital gain of Rs 1,00,080 in your book. Your long term capital gain tax for this transaction will be Rs 8. You then again buy 328 shares of Finolex Industries on March 25, 2021 at the same price of Rs 610, now your cost of acquisition in the books become Rs 2,00,080.

Now let us assume that on March 25, 2022, shares of Finolex Industries are trading at Rs 915 apiece and that’s when you decide to book profits and exit the stock, you would have realised Rs 3,00,120 (328 shares x 915). Thanks to the tax-harvesting transaction, your long-term capital gain on March 25 2022, will be Rs 1,00,040 (3,00,120 – 2,00,080) and the tax outgo will be Rs 4. So, your total LTCG tax would be Rs 12 of which Rs 8 were paid on the tax harvesting transaction done on 24th March 2021.

But if you wouldn’t have done a tax-harvesting transaction your LTCG would work out Rs 2,00,120 (3,00,120 –1,00,000). The LTCG tax on this would be Rs 10,012 (10% of 1,00,120) as Rs 1,00,000 is exempted. Here is the detailed matrix to compare.

For the above calculations, we have assumed that you are a first-time investor and have only Finolex Industries in your portfolio and you managed to repurchase the same price of Rs 610 for tax harvesting.

While tax-harvesting does help save tax of Rs 10,000 per year but there some costs involved in tax-harvesting like brokerage, STT, stamp duty, the difference in price selling and buying shares on different dates as so on. While these costs will be marginal, but it may work out to be 1-1.5% of the total amount.

One also needs to understand for maintaining continuity of investments, you will need to reinvest as soon as you sell the older units for tax-harvesting. This will require you to have surplus cash in order to make the buy transaction. As the sales proceeds will be credited to your bank account only on the third day after the transaction. If an investor waits for these to be available for reinvestment, it could cause a significant opportunity loss. Apart from this, you also have to undertake the periodic exercise of selling part of your investments in each financial year.